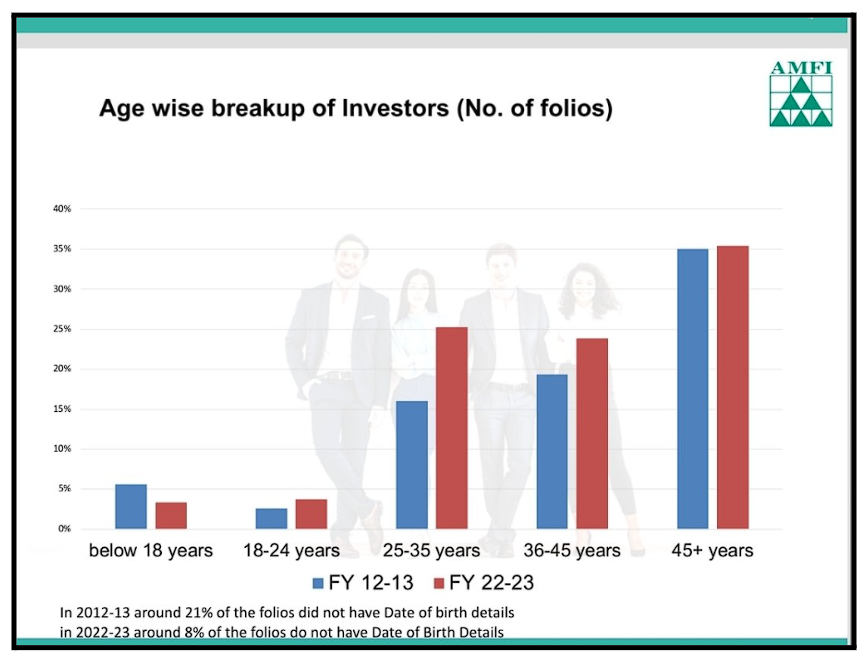

According to this recent data from AMFI, people in their 40s are investing more through mutual funds than their younger counterparts in their 20s and 30s. Well, I guess it’s time to drop some truth bombs about why young people are missing out on the mutual fund craze.

Firstly, let’s address the elephant in the room: millennials are busy building their lives, which includes everything from getting married to buying houses to having kids. I mean, who has the time or energy to invest in mutual funds when you have to pick out the perfect shade of grey for your living room walls, right?

But here’s the thing – while all those things are important, it’s equally crucial to start investing in mutual funds, because let’s be real, those living room walls won’t pay your bills in your golden years. Mutual funds are the safest way to grow your money without directly getting involved in the stock market, which can be about as predictable as the weather in Pune nowadays.

Now, I know what you’re thinking – “But wait, I want to be the next Rakesh Jhunjhunwala!” And sure, who wouldn’t want to be a billionaire investor? But let’s face it, not everyone can be a stock market genius. That’s why it’s important to take the smartest approach and put your eggs in different baskets – some in the stock market, some in mutual funds, and maybe even a few in the metaphorical basket of running up Vetal Tekdi, while it still exists (read health).

Let’s start with the basics – mutual funds are professionally managed investment portfolios that pool money from multiple investors to invest in a diversified mix of stocks, bonds, or other assets. The key advantage of investing in mutual funds is that it allows you to gain exposure to a diverse range of assets, without having to directly invest in individual stocks.

It’s important to understand that mutual funds are an excellent way to save for the future. Inflation rates in India have been high, and it’s essential to invest in avenues that can beat inflation and provide returns that are higher than traditional savings accounts.

However, many young people have a misconceived notion that investing in mutual funds is only for wealthy or experienced investors. This is far from the truth. In fact, there are several mutual funds available in the market that cater to different risk appetites and investment goals. Whether you’re looking for a high-risk, high-reward option or a more conservative approach, there’s a mutual fund out there for you.

Yes, SIP may seem like a boring and mundane approach, but it has many advantages, like inculcating savings habits, building a corpus in long term, taking advantage of rupee cost averaging, and compounding. SIPs allow you to invest a fixed amount of money every month, which is then invested in a mutual fund of your choice. The key advantage of SIPs is that they promote discipline and consistency, which are key factors in building long-term wealth. And who knows, maybe in 20 years, you’ll be sipping on fancy cocktails in Seychelles while your mutual fund does all the heavy lifting.

Furthermore, with the rise of digital investment platforms, investing in mutual funds has become easier than ever before. With just a few clicks on your smartphone, you can start investing in mutual funds, track your investments, and even automate your investments through SIPs.

In conclusion, let’s remember the wise words of Warren Buffett – “Someone’s sitting in the shade today because someone planted a tree a long time ago.” So, plant that tree, water it with your savings, and watch it grow into a mighty mutual fund tree. And who knows, maybe someday you’ll be the one sitting in the shade, sipping a cocktail, and telling your friends, “Yeah, I invested in mutual funds when I was in my 20s.”